What Is The Income Limit For Ira Contributions In 2025

What Is The Income Limit For Ira Contributions In 2025. These limits saw a nice increase, which is due to higher. 2025 and 2025 roth ira income limits;

Income limits are also higher — albeit modestly — for iras. For 2025, the limits on modified adjusted gross income (magi) to be eligible for a roth ira can be.

The roth ira income limits are $161,000 for single tax filers, and $240,000 for those married filing jointly.

2025 Traditional Ira Limits Elaina Stafani, Married filing jointly or qualifying widow(er) less. For 2025, the limits on modified adjusted gross income (magi) to be eligible for a roth ira can be.

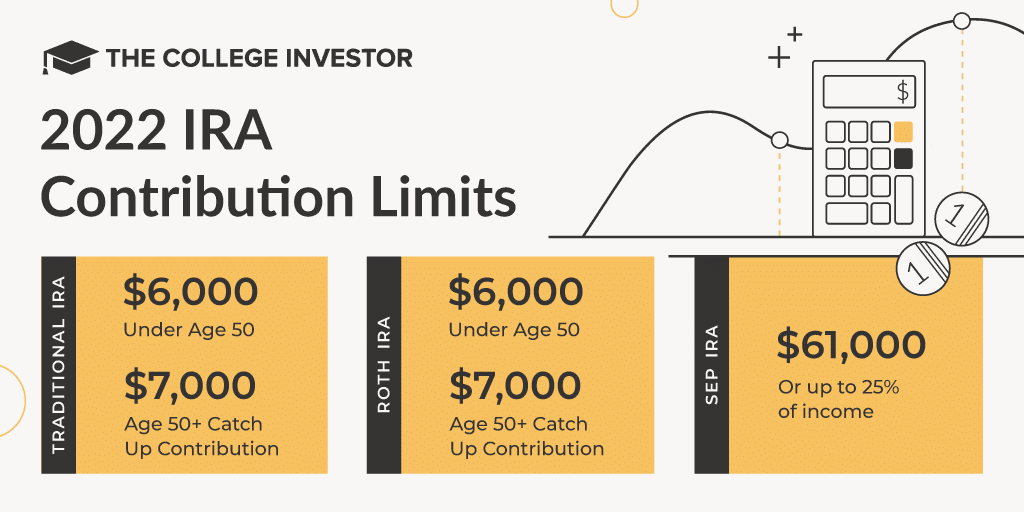

Roth Contribution Limits 2025 Minda Lianna, Like traditional iras, roth ira contributions for 2025 are limited to $6,500, or $7,500 if you’re 50 or over. Those limits reflect an increase of $500.

What Is The Limit For Roth Ira Contributions In 2025 Winna Kamillah, The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older. In 2025, you can contribute up to $7,000 to a traditional.

IRA Contribution Limits 2025 Finance Strategists, Every year, the irs makes cost of living changes to the ira contributions limits. In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira contribution may be limited based on your filing status.

The IRS just announced the 2025 401(k) and IRA contribution limits, Roth ira income and contribution limits. The roth ira income limits are $161,000 for single tax filers, and $240,000 for those married filing jointly.

Limit Roth Ira 2025 Sadye Conchita, Filing status 2025 modified agi 2025 modified agi contribution limit; The irs announced the 2025 ira contribution limits on november 1, 2025.

What Is The Ira Contribution Limit For 2025 2025 JWG, In 2025, you can contribute up to $7,000 to a traditional. Like traditional iras, roth ira contributions for 2025 are limited to $6,500, or $7,500 if you’re 50 or over.

IRA Contribution Limits And Limits For 2025 And 2025, The irs announced the 2025 ira contribution limits on november 1, 2025. The total combined limit for contributing to an ira (including traditional and roth) is:

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Those limits reflect an increase of $500. For 2025, the limits on modified adjusted gross income (magi) to be eligible for a roth ira can be.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, 2025 roth ira income and contribution limits. Filing status 2025 modified agi 2025 modified agi contribution limit;

The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age 50 or older.